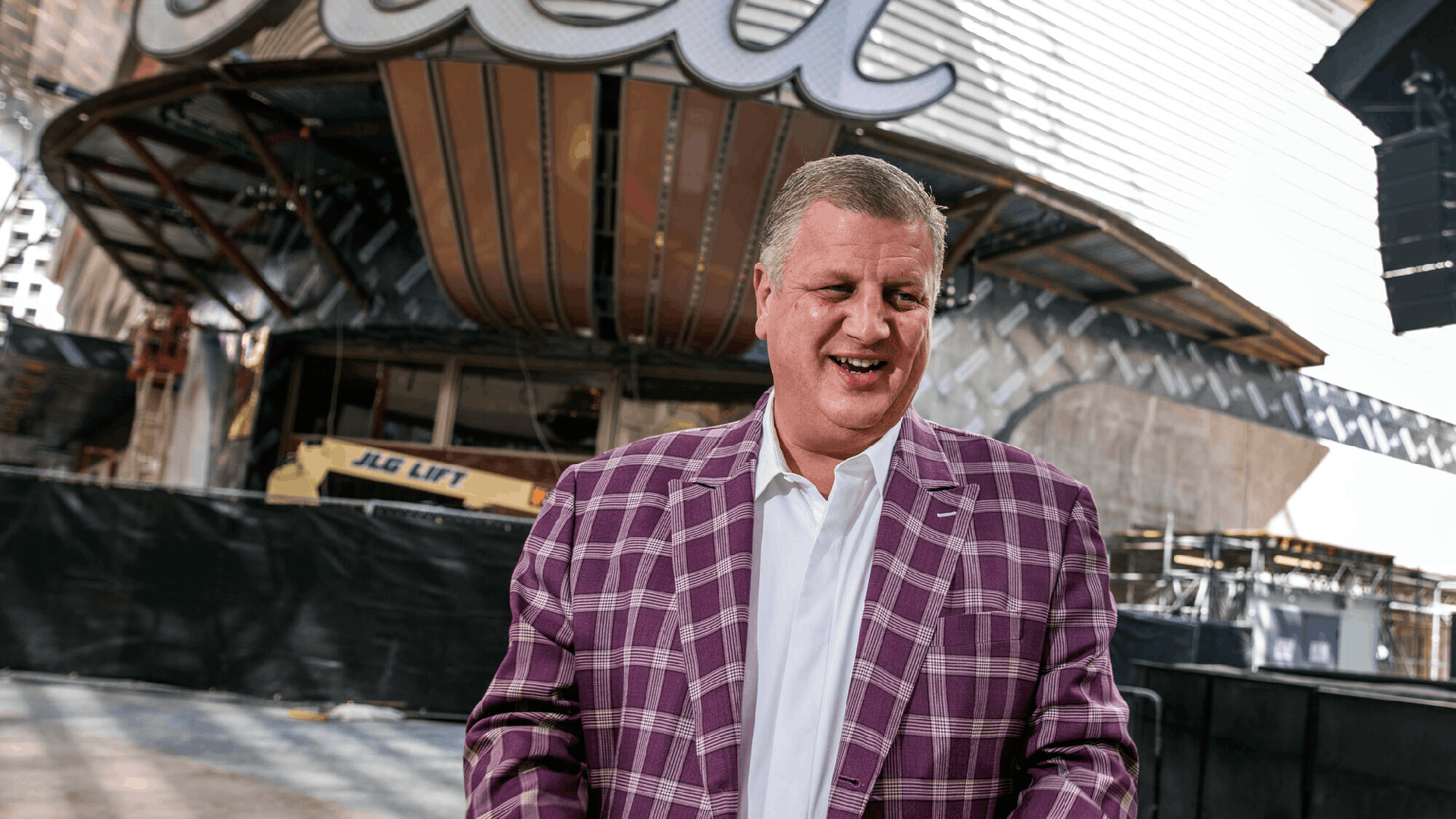

One of America's most admired casino owners, Derek Stevens, whose appeal cuts across party lines, is urging Congress to address a tax consequence of the One Big Beautiful Bill (OBBB) that reduces deductions for gaming losses starting next year.

The American Gaming Association (AGA) President Bill Miller, MGM Resorts CEO Bill Hornbuckle, Caesars Entertainment CEO Tom Reeg, and Wynn Resorts CEO Craig Billings met with US Rep. Jason Smith (R-MO), the chair of the House Ways and Means Committee, recently to discuss the 90% deductibility of gambling losses required in the Republicans' bill, Stevens, whose Circa has completely changed downtown Las Vegas, wrote on X. The IRS will only permit an itemized filer to deduct 90% of their losses against their wins beginning in 2026, whereas a gambler may deduct up to 100% of their losses under the present tax system.

"This was an inadvertent element of the One Big Beautiful Bill. Government has a lot of difficult things to deal with, but this should not be one of them,” Stevens said.

Stevens begged his X supporters to urge their legislators to back the bipartisan proposals that Sens. and Rep. Dina Titus (D-NV) had filed. Ted Cruz (R-TX) and Catherine Cortez Masto (D-NV) would increase the gambling deduction allowance back to 100%.

According to Stevens, requiring gamblers to pay taxes on phantom revenue would have a significant effect on the travel and hospitality sectors as well as the workers in those businesses. Additionally, "most of America who's made a bet in the last year" would be in danger.

Smith has been charged with blocking Titus' FAIR Bet Act from going to the House floor for a committee vote. According to Stevens, the congressman instructed the casino group's members to contact their US senator and House representative and request their support for the FAIR Bet Act and Cortez Masto and Cruz's FULL House Act, both of which would increase the gambling deduction back to 100%.

On Thursday, Titus urged Smith to speed a hearing for her FAIR Bet Act, which has the support of 21 House members, including 8 Republicans and 13 Democrats.

"While the change may appear minor, it will have significant and harmful consequences. It unfairly burdens professional gamblers and casual players alike and will inevitably drive players toward offshore and unregulated markets where consumer protections are nonexistent, thereby undermining responsible gaming efforts nationwide,” Titus wrote Smith.

The AGA, MGM, DraftKings, FanDuel, Caesars, Wynn, the Nevada Resort Association, and the National Thoroughbred Racing Association endorse FAIR Bet in addition to the almost two dozen US representatives.

The chances of the gambling deduction returning to 100% before 2026 increase as the holidays and year's end draw near. To preserve the full wagering deduction, the statute may be changed to make the deduction retroactive to January 1, 2026, if Congress passes FAIR Bet or Full House the following year.

Promoted casinos refer to online gambling platforms that are actively marketed and recommended by various sources, including websites, affiliates, and influencers. These casinos often feature prominently in advertisements and top lists due to their attractive offers, high-quality games, and reputable services.

Instead of having to go to a real casino, players may enjoy their favorite games whenever they want, from any location. Those who reside far away from a land-based casino or have hectic schedules will find this particularly enticing.

In comparison to land-based casinos, online casinos frequently have a greater selection of games. This covers many kinds of table games, live dealer games, slots, and specialty games.

The security and anonymity that come with playing online are valued by many players. Without the possible distractions or social pressure of actual casinos, they can play their favorite games.

Numerous payment options are available at online casinos, including bank transfers, e-wallets, credit/debit cards, and even cryptocurrency. It is simpler for players to deposit and withdraw money thanks to this flexibility.